Public EditionGlobal snapshot of money laundering trends

Published annually, the Public Edition of the Basel AML Index ranks countries with sufficient data to calculate a reliable risk score. It is a snapshot of global ML/TF risks and progress by countries and regions over time.

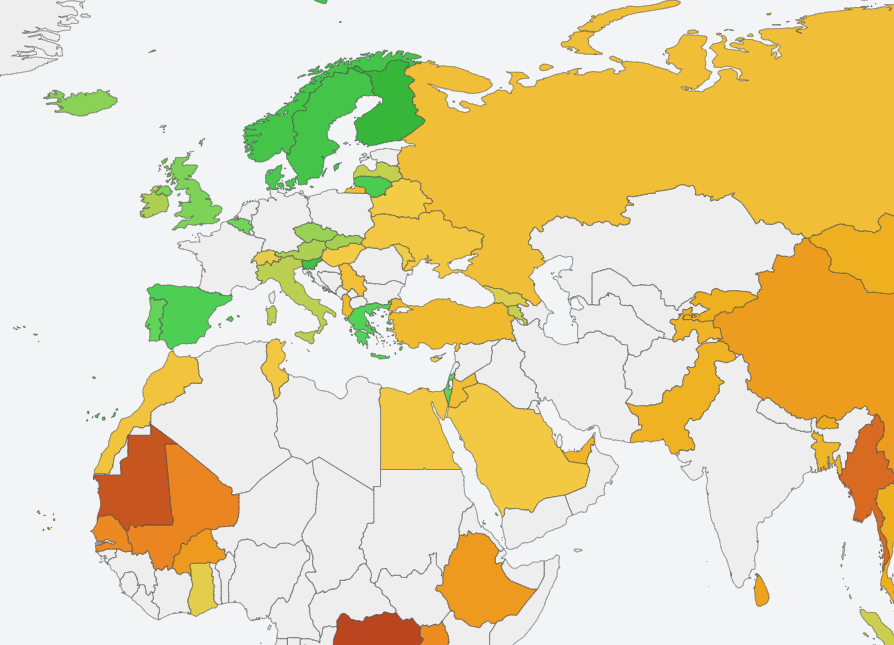

Map

Our interactive map displays overall ML/TF risk scores for the 152 jurisdictions included in the 2023 Public Edition of the Basel AML Index.

Ranking

Explore the Public Edition Ranking Table with 152 jurisdictions with sufficient data to calculate a reliable ML/TF risk score.

Report

Download the Basel AML Index 2023: 12th Public Edition report containing the ranking and regional infographics.

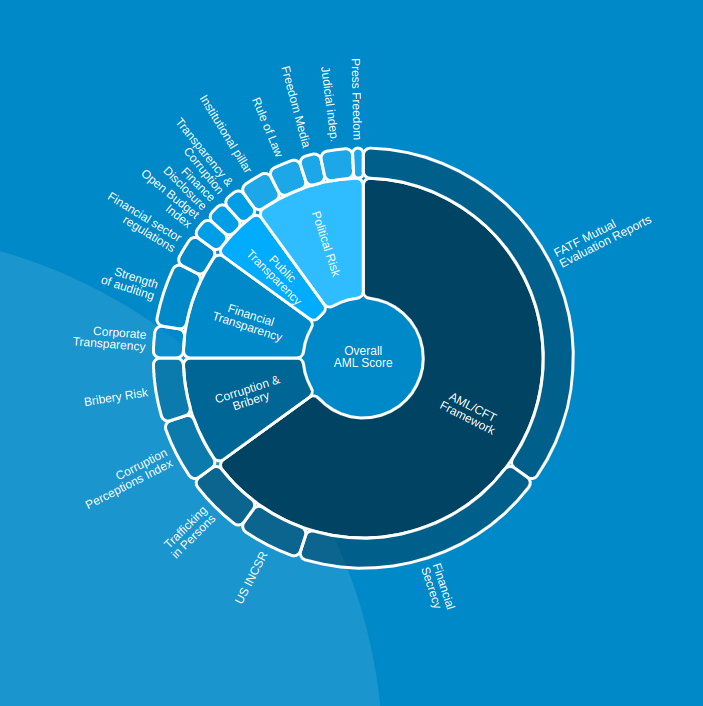

Holistic picture ofmoney laundering risk

The Basel AML Index is an independent country ranking and risk assessment tool for money laundering and terrorist financing (ML/TF).

Produced by the Basel Institute on Governance since 2012, it provides holistic money laundering and terrorist financing (ML/TF) risk scores based on data from 18 publicly available sources such as the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum.

- Indicators

- 18

- Domains

- 5

- Jurisdictions

- 152

Expert EditionEnhanced coverage

The Expert Edition is a subscription-based tool for anti-money laundering professionals and others involved in compliance, due diligence and risk evaluation.

More features. More insight.

Updated quarterly, the interactive map and dashboard cover 203 countries, with multiple options to filter and download the data, as well as access to jurisdiction profiles and comparison of the risk scores to regional and world averages.

The Expert Edition Plus offers a detailed comparative analysis of the FATF Mutual Evaluation Reports. This allows users to assess each FATF recommendation individually by focusing on specific compliance needs, for example due diligence or terrorist financing regulations.

Free access

The Basel AML Index Expert Edition and Expert Edition Plus are FREE for public-sector, international, non-profit, academic and media organisations.

Testimonials

Financial institutions, companies, supervisory bodies and research institutions of all sizes use the Basel AML Index Expert Edition interface and data. It is a fast, efficient and cost-effective way to evaluate ML/TF risks and fulfil regulatory and compliance requirements.

The Economist describes the Basel AML Index as a leading index of money-laundering risk.

The Global Corruption Index uses data from the Basel AML Index as an indicator of white- collar crime.

The Wolfsberg Group quotes the Basel AML Index in its FAQ on country risk assessment.

The Swiss Finance Institute uses Basel AML Index risk scores to help rank countries in its Global Financial Regulation, Transparency, and Compliance Index.

The European Commission recommends the Basel AML Index in its methodology for identifying high- risk third countries. Its Transitions Performance Index uses Basel AML Index scores to help assess countries' progress in governance and transparency.