Webinar2025 Basel AML Index launch

Catch up with the launch of the 2025 Public Edition of the Basel AML Index. It features an overview of this year's key findings and a discussion with experts from the European Central Bank, Wolfsberg Group and Malawi Financial Intelligence Authority.

Holistic picture ofmoney laundering risk

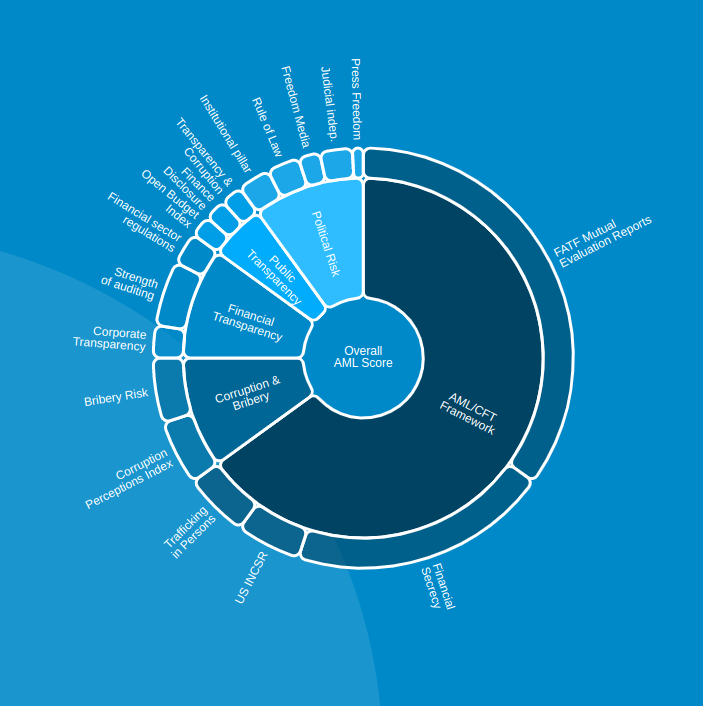

The Basel AML Index is an independent ranking and risk assessment tool for money laundering and related financial crime risks. Produced by the Basel Institute on Governance since 2012, it provides a holistic picture of money laundering risks around the world.

The risk scores are based on data from 17 publicly accessible sources such as the Financial Action Task Force, Transparency International and the Global Initiative against Transnational Organized Crime.

- Indicators

- 17

- Domains

- 5

- Jurisdictions

- 177

Expert EditionsEnhanced coverage

Explore and download our full data and analysis – updated quarterly and with free access for public, non-profit, multilateral and academic organisations, plus the media.

More features. More insight.

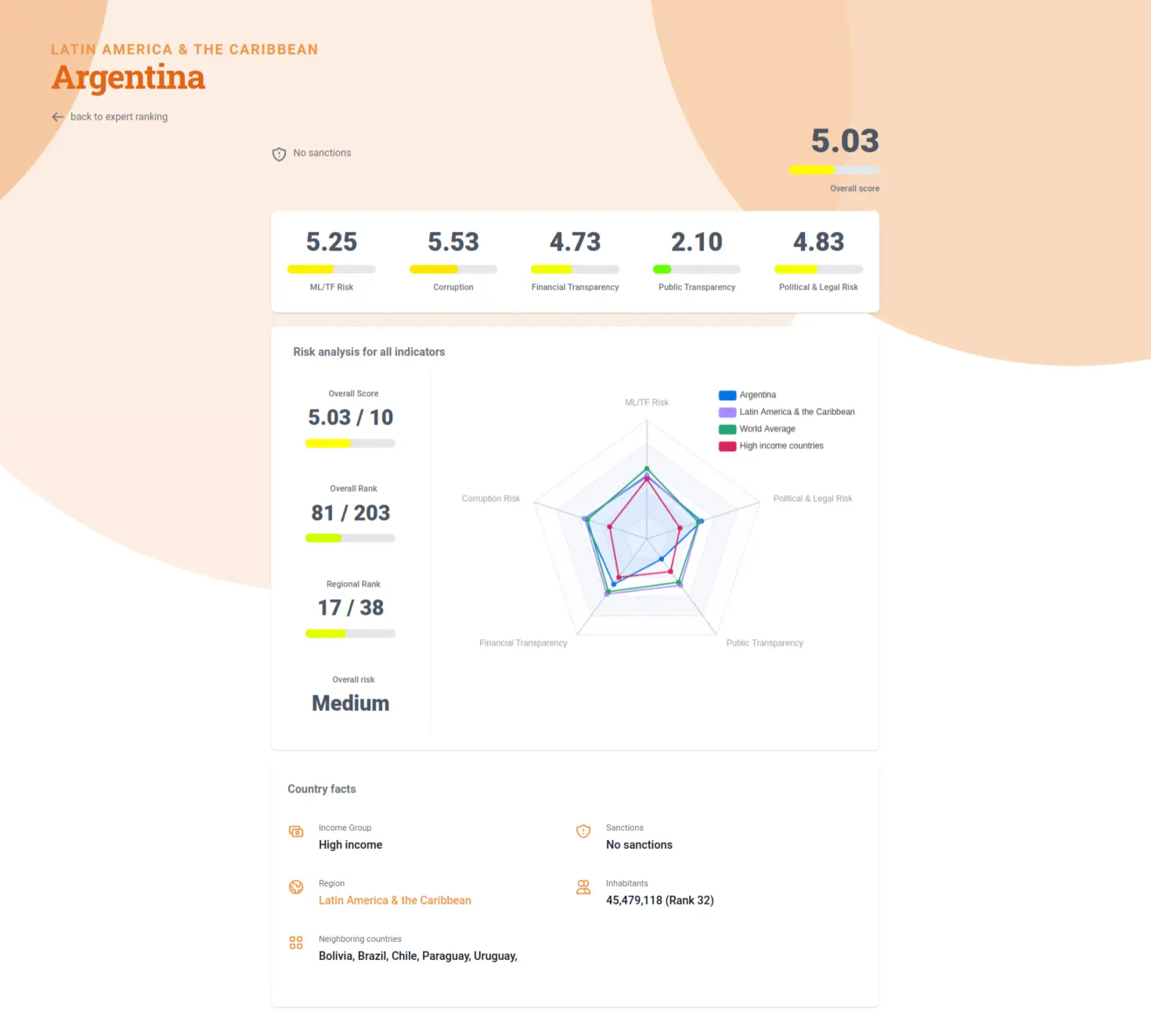

Updated quarterly, the Expert Edition map and dashboard cover 203 countries and jurisdictions. You can filter and download the data, as well as visualise risk factors for each jurisdiction and compare risk scores to regional and world averages.

The Expert Edition is a fast, efficient and cost-effective way to evaluate money laundering and related financial crime risks, benchmark risk assessment systems and fulfil regulatory and compliance requirements.

Expert Edition Plus offers a detailed spreadsheet and written analysis of the latest FATF data. This allows users to assess each FATF Recommendation individually by focusing on specific compliance needs, for example due diligence or terrorist financing regulations.

Free access

The Basel AML Index Expert Edition and Expert Edition Plus are FREE for public, non-profit, multilateral and academic organisations, plus the media.